Gold: Legacy, Insights,

and Investment Potential

Historical Significance:

Gold has been important throughout history as a symbol of wealth and power. It has played a significant role in shaping societies and economies worldwide.

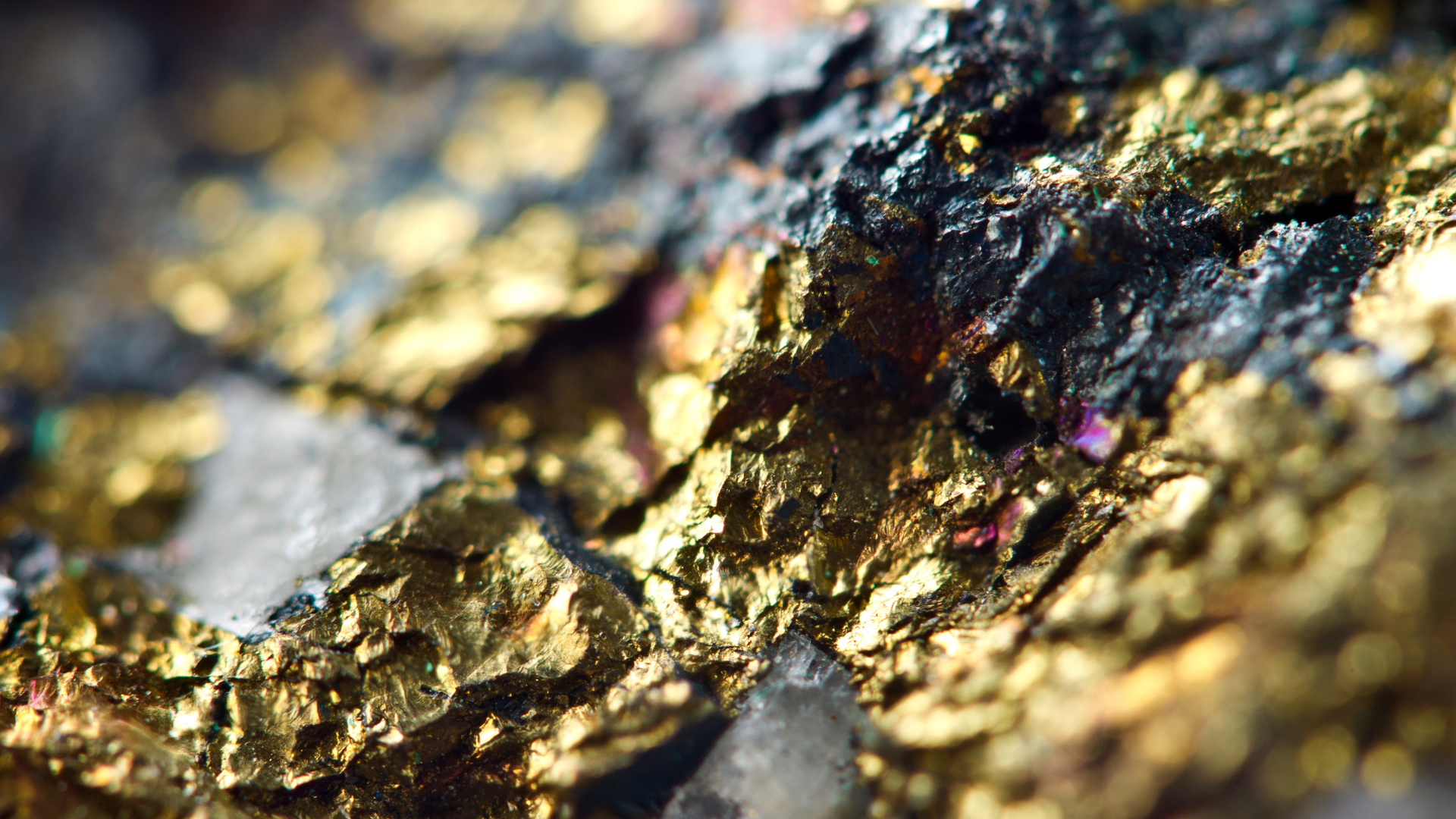

Physical Properties:

Gold is exceptionally malleable and ductile, making it the softest and most dense metal, renowned for its conductivity and resistance to corrosion.

A Tangible Asset:

Gold stands out as a tangible asset, offering a unique investment opportunity that can be physically preserved and passed down through generations.

Investment Portfolio Diversifier:

Including gold in a diversified portfolio helps reduce overall risk and enhance stability, making it a strategic asset for long-term financial security.

Gold in Mining Stocks:

Exploration companies drive the discovery of new gold deposits, ensuring a steady future supply. Mining companies focused on both the production and exploration of gold provide significant opportunities for long-term results.

In the Global Economy:

Gold acts as a hedge against currency depreciation and inflation, preserving wealth by maintaining its value when traditional currencies fluctuate.

Geopolitical risks and evolving economic factors are speeding up the shift away from the U.S. dollar.

“Rising geopolitical tensions and gold’s role as a safe haven asset”

Instances of conflict or warfare among nations have the potential to cause currency devaluation or depreciation. In response, investors might opt for gold as a safeguard against such currency fluctuations, given that gold isn’t linked to any particular currency and maintains its inherent value.

Central Banks Boost Gold Reserves to Diversify from the Dollar

Central banks prioritize gold due to its status as a tangible asset, distinct from assets entangled within the financialized system when directly owned. However, the primary motive is the aspiration to diversify away from reliance on the dollar. For countries with strained relations with the US, holding gold serves as a means to safeguard reserve assets from potential seizure, a scenario exemplified by Russia’s experience.